World’s first Development Impact Bond on track to deliver social impact and financial returns

Early results show this innovative model is closing the gender gap in enrolment and improving children's learning levels

- First-year results show India DIB tracking against 2018 targets to enrol out of school girls and improve learning

- Indian implementer Educate Girls says DIB has been transformational in delivering impact

Early results from the first Development Impact Bond (DIB) to go into operation show the model is closing the gender gap in enrolment and improving children’s learning levels in its target area in Rajasthan, India, its backers said today. This means the DIB is on track to meet its ambitious three year targets.

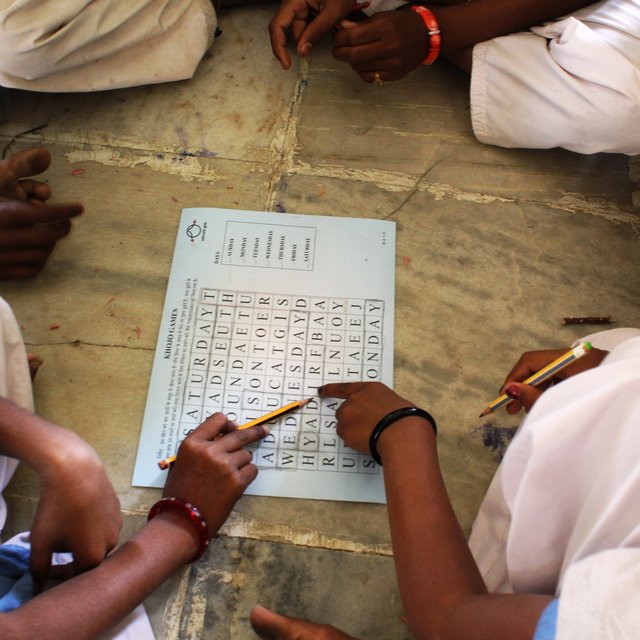

The DIB is funding a three-year program implemented by award-winning Indian NGO Educate Girls to enrol and educate marginalized girls and boys in a remote rural district of Rajasthan. This innovative new way of financing international development is entirely focused on a set of social impact outcomes that are rigorously measured by an independent evaluator. In this case, the outcomes measured by the evaluator, IDinsight, were the numbers of girls enrolled into primary education and students’ progress in English, Hindi and maths.

After around a third of the full DIB term has elapsed, results show the program has enrolled 44% of all out-of-school girls identified in year 1, and has achieved 23% of the total target for learning progress.1 Based on this progress, the Zurich-based UBS Optimus Foundation which provided the upfront investment for the DIB would have already recouped approximately 40% of the initial investment in year 1, a promising performance despite challenges in launching the intervention on time.

The DIB funded program’s ultimate goal is to improve education – directly and indirectly through general improvements in targeted schools – for 15,000 children, 9,000 of them girls, in 166 schools in 140 villages in Bhilwara District. Rajasthan was chosen as it has particularly poor indicators for girls’ education.

Phyllis Costanza, CEO of the UBS Optimus Foundation said:

“Harnessing the power of private capital will be crucial to raising the trillions of dollars needed to achieve the world’s new development goals, and while this first Development Impact Bond is not the only game in town, it is leading the way in demonstrating how such innovative financing models can unlock new and much needed sources of funding and deliver even greater impact on the ground.”

Educate Girls’ DIB program has accelerated learning gains by 30% in its short first year of implementation. Safeena Husain, Executive Director of Educate Girls said the DIB’s focus on data collection and analysis has had profound effect on the organisation’s way of working.

“The DIB has actually transformed the way we think about our impact,” she said. “Because of this focus on results, we have increased the feedback of data from the field that is shared among all staff we are continually analysing where things are working well and where we need to make changes. This flexible and responsive approach inherent in the results focus is now being adopted across our other programs. The main driver for us testing the DIB was to demonstrate we can deliver quality at scale, not just scale.”

Ms Husain cited the example of when, half way through the delivery of the curriculum, data showed that the girls in the program were falling behind with English. Investigations revealed that some teachers were uncomfortable about their own ability in English and struggling with the lesson plans, so measures were immediately taken to give them more support in English and the girls’ learning accelerated.

At the end of the three-year DIB program, the initial investment will be paid back by the outcome payer, in this case the Children’s Investment Fund Foundation (CIFF). CIFF will pay interest of up to 15%, depending on how far the children’s learning targets are achieved. Educate Girls will also receive part of this payment if it achieves its targets.

Kate Hampton, CEO at CIFF, said:

“We’re excited by the Development Impact Bond as an innovative way to attract a range of investors to crucial social services. While this is designed to improve the quality of girls’ education in Rajasthan, the concept could be attractive to funders across a range of issues who want to make investments with both financial and social returns. The first year has been successful for both children’s learning outcomes and for us as we’ve been learning how to manage the challenges that are inherent in any new financial instrument”.

While the DIB’s backers said they were encouraged by the experiences and results from the first year, they emphasized that DIBs should not be seen as a panacea and, like any such instrument, they will only be relevant for quite specific scenarios. They reported having learned valuable lessons about the opportunities and challenges of the model, potentially paving the way for the next generation of DIBs.

Avnish Gungadurdoss of the results-based financing consultancy Instiglio that designed the DIB and is providing performance management support to Educate Girls said:

“Any service provider contemplating taking a first step into results-based financing needs to be confident that it has a rigorous understanding of the issue to be addressed and of its past results, the leadership bandwidth to lead a culture of performance and the internal performance management systems to manage outcomes. Only then should a judgment be made as to whether a Development Impact Bond is the best way forward.”

The first-year results were featured as part of an event today at London’s Overseas Development Institute (ODI) and a webinar co-hosted with the Brookings Institution in Washington DC.

To learn more about the Educated Girls DIB, read our grant page or visit https://instiglio.org/educategirlsdib/